S

U

B

S

C

R

I

B

E

Am I

Eligible?

Join Class Actions Blog & News

Dangerous Above-Ground Pool Recall

What Happened? A major recall has been issued for certain above-ground pools after a tragic design flaw resulted in the deaths of nine young children between the ages of 22 months and 3 years...

Navy Federal Credit Union Overdraft Fees Investigation

Were You Charged Overdraft Fees by Navy Federal Credit Union? You may be owed compensation. We’re investigating reports that Navy Federal Credit Union may have unlawfully charged overdraft fees...

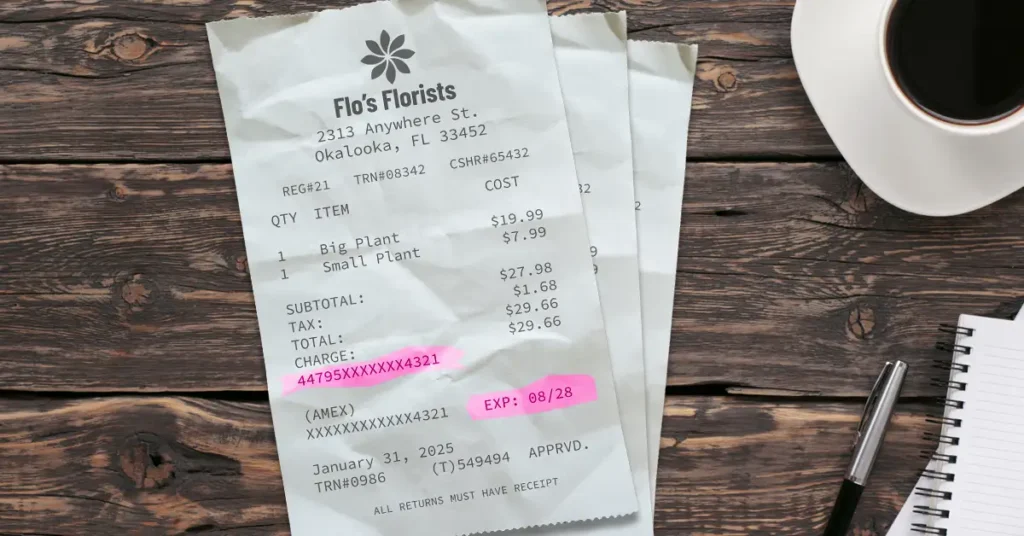

FACTA Receipt Violations

Check Your Receipts — Your Privacy May Have Been Violated Did you receive a printed receipt in the past two years that shows more than the last five digits of your credit or debit card number or...

AbbVie GIPA Privacy Violation Class Action

Did AbbVie Collect or Use Your Genetic Data Without Your Permission? You Could Be Owed Thousands If you provided personal or genetic health information to AbbVie—for a clinical study, trial,...

HealthTrust Travel Nurse Housing Stipend Investigation

HealthTrust Travel Nurse? Your Housing Stipend May Have Been Improperly Reduced If you received a housing stipend while working for HealthTrust, you may have had it unfairly reduced or...

Xfinity Employee Class Action Investigation

Did You Work at Xfinity or Comcast? You Could Be Owed Money If you’re a current or former employee of Xfinity (Comcast) and were underpaid, denied overtime, or had your rights violated at...

New Mexico GIPA Violations Investigations

Were You Asked About Your Family’s Medical History During a Job Exam in New Mexico? You May Be Entitled to Compensation Under the Genetic Information Privacy Act (GIPA) Are you a current or...

LRS Healthcare Housing Stipend Investigation

Travel Nurses: Did You Receive Housing Stipends from LRS in the Last 2 Years? You May Be Owed Compensation Are you a current or former travel nurse employed by LRS Healthcare? If you received...

Are You Owed Overtime on Bonuses?

If You’re an Hourly Worker Who Gets Bonuses, You May Be Owed Thousands in Unpaid Overtime Many employees don’t know this—but if your overtime pay hasn’t increased when you get a bonus, your...

Nicotine Surcharge Lawsuits

Were You Charged More for Health Insurance Because You Smoke or Vape? You May Be Entitled to Money If you were charged a higher premium on your health insurance at work because of your tobacco...

Safelite AutoGlass Employees Tobacco Surcharge Class Action

Did Safelite Charge You Extra for Smoking or Not Getting a Vaccine? You May Be Owed Compensation If you are a current or former Safelite AutoGlass employee and paid extra for your health...

Aimbridge Hospitality Employees Nicotine Surcharge Lawsuit

Did You Work at Aimbridge Hospitality and Pay a Tobacco Surcharge? You Could Be Owed Money If you are a current or former Aimbridge Hospitality employee who smokes or vapes, you may have been...